- #2016 EXTENSION FORM IF THERE IS A REFUND UPDATE#

- #2016 EXTENSION FORM IF THERE IS A REFUND SOFTWARE#

- #2016 EXTENSION FORM IF THERE IS A REFUND DOWNLOAD#

Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or

See the CONTACT US link at the top of this page. You can go to your Safari menu, preferences and then security to allow pop-ups. Mac Users: Safari may block pop ups on default.

#2016 EXTENSION FORM IF THERE IS A REFUND UPDATE#

For the best user experience on this website, you should update your browser ( Internet Explorer, Chrome, Firefox or Safari ). Allow the pop-ups and double-click the form again.

#2016 EXTENSION FORM IF THERE IS A REFUND DOWNLOAD#

For example, you can now e-file amended Forms 1040, 1040. If you prefer that we complete your tax form, you can click here to download a Tax Form Completion Request and either mail it or drop it in the Drop Box. If you click on a folder and run a search, it will only search that. Since then, the IRS has added more options that you can use to electronically correct or amend returns. Note: Your browser may ask you to allow pop-ups from this website. Click on the folders below to find forms and instructions. If you click on a folder and run a search, it will only search that folder. Click on the folders below to find forms and instructions. You May Mail a Paper Return Directions to print forms:ġ.

#2016 EXTENSION FORM IF THERE IS A REFUND SOFTWARE#

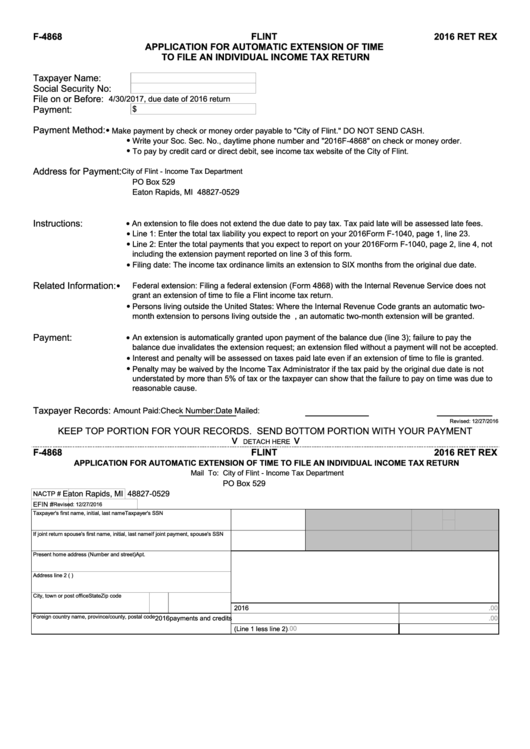

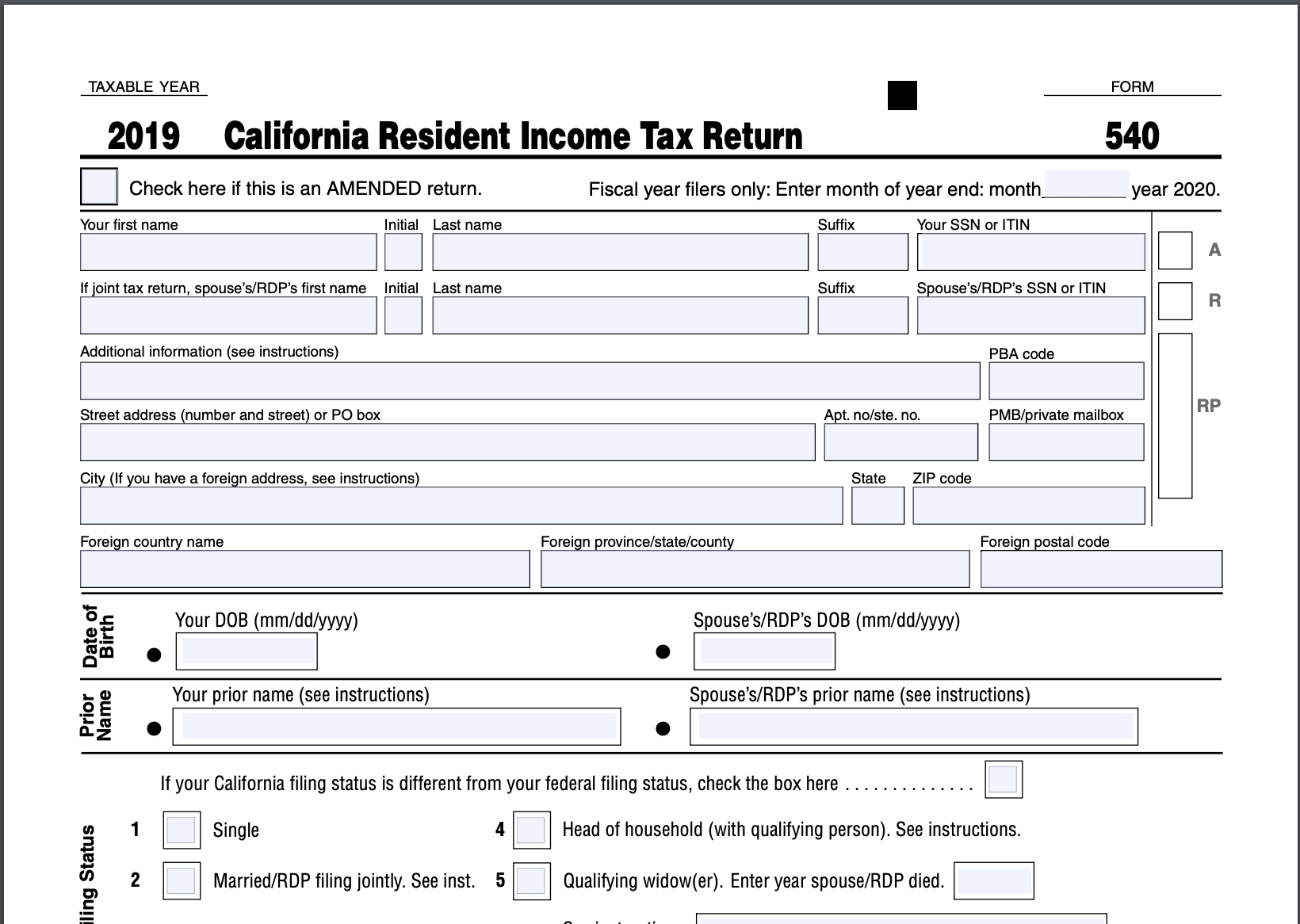

There are three ways to file: (1) using our website, at no cost, (2) purchasing software to prepare your taxes or (3) using a tax professional to file electronically. As the IRS is issuing Economic Impact Payments to Americans, the agency urges taxpayers who haven't filed past due tax returns to file now to claim. To claim the refund, a return for tax year 2016 must be filed by July 15, 2020.' In Notice 2020-23 PDF, the IRS extended the due date for filing tax year 2016 returns and claiming refunds for that year to July 15, 2020, as a result of the COVID-19 pandemic. The Department encourages all taxpayers to file electronically it’s fast and secure. There's only a three-year window to claim these refunds, and the window closes on July 15. For more information see our Forms & Publications page or the forms and instructions provided in the Browse or Search Forms section below. If you are requesting an extension of time to file and to pay, attach Form CT1127 on top of your Form CT-1040 EXT (make any payment that you can). Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal Income Tax Return.ĭepending upon your residency status and your own personal situation, you may need other forms and schedules.

0 kommentar(er)

0 kommentar(er)